Important Notice

Glossary

1. “The Bank” – means Banco Comercial de Macau, S. A. (“the Bank”)

2. “This site” – means the internet website of Banco Comercial de Macau, S. A. (www.bcm.com.mo)

3. “E-Banking Services” – means BCM Net e-Banking Services, BCM eCorp Internet Banking Services, I-Securities Trading Services and Mobile Securities Trading Services.

4. “E-Channels” – means Internet and/or mobile data network.

Viewing Notes

1. Some information of this site and E-Banking Services may be available in Chinese or English only.

2. This site and E-Banking Services is best viewed at 1024 x 768 screen resolution with Internet Explorer 8.0 or above.

3. This site and E-Banking Services web pages appearance may differ depending on the browser used.

4. Please install Adobe Acrobat Reader 5.0 or above to view some of the documents in downloadable forms.

Use of Information and Materials

All information and materials provided in this site and E-Banking Services, whether provided by the Bank or any other information provider, are not intended to provide professional advice to its users. All investment products and services are not obligations of or guaranteed by the Bank and are subject to investment risks.

No Guarantee

All information and materials provided in this site and E-Banking Services, whether provided by the Bank or any other information provider, are provided for general information purposes only and are subject to change without prior notice to its users. While the Bank has exercised every effort to ensure the accuracy, no guarantee regarding the accuracy or completeness is given in connection with this information and materials.

Internet Communications

The Customer understands that due to unpredictable traffic congestion, openness and public nature of E-Channels and other reasons, E-Channels may not be a reliable medium of communication and that such unreliability is beyond the control of the Bank. This may be subject to delays in transmission, incomplete data transmission, delays in execution or execution of instructions at prices different from those prevailing at the time instructions were given, misunderstanding and errors in any communication between the Bank and the Customer, transmission blackouts, interruptions and so on.

Limitation of Liability

Under no circumstances, neither the Bank or its members will be liable or bear the responsibilities for any loss or damages of any kind, whether direct, indirect special, incidental, or consequential losses, arising from accessing this site and E-Banking Services or use or inability to use by any party.

Hyperlink Policy

The Bank may provide hyperlinks to other web site under our site and E-Banking Services. These third party web sites are not affiliated with or in any way related to the Bank. We wish to acknowledge that we are providing such hyperlinks for information purposes only.

The provision of hyperlinks in our site and E-Banking Services to external or third party web sites does not and in no way represent any forms or recommendation, endorsement, approval, guarantee or introduction of any third parties or the products and services that they provide, or any form of co-operation between the Bank and such third parties unless otherwise stated by the Bank. Additionally, the Bank is not a party to any contractual arrangements that the user and the provider of the third party web site or any third party that the user may enter into, unless otherwise specifically agreed to by the Bank.

Users are strongly advised that they use the hyperlinks at their own risk. The Bank is not responsible for any loss, damage, or consequence that may, directly or indirectly, arise from the use of hyperlinks. Nor shall be held liable for the accuracy, truthfulness, or whatever of the contents of such third party web sites.

The hyperlinks to third party web sites may contain downloadable software that is for convenience only. Once again, the Bank shall not be held responsible for any problems or difficulties that may encounter in downloading or installing such software. Please bear in mind that the use of any software downloaded from E-Channels may be governed by a license agreement. The Bank is not in any way responsible for any infringement by the user of intellectual property rights of the relevant software provider by failing to adhere to the terms of such license agreement.

When using this hyperlink service, users must observe the terms of use and the relevant rules and conditions stipulated by the Bank as well as those set down by the site, E-Banking Services and other third party web sites.

Copyright

The ownership of all information and materials provided in this site and E-Banking Services belong to the Bank or any other information provider and subject to the Copyright. Without the prior written approval by the Bank, neither party could copy, reproduce or distribute any of the information or materials provided in this site and E-Banking Services.

Internet Security

Is it secure to make a transaction using the E-Banking Services?

Our E-Banking Services provide the following measures to ensure your banking information and account details are secure when you are using our E-Banking / Mobile Securities services:

- Transport Layer Security (TLS) & Strong Encryption (128 bit)

Transport Layer Security version and 128 bit encryption is employed to

ensure confidentiality. All data and information transmitted between you

and the Bank through E-Channels is encrypted by using 128-bit encryption.

To ensure your online transaction information is encrypted, look for the ‘lock

icon’ in the status bar on the right hand corner of your Internet browser of

your PC while you are connected.

- User Name and Password

To strengthen internet security, you are required to set up a “Username” and

change your “Password” regularly.

- Two factor authentication method

The Bank adopts the Two-Factor Authentication Technology, which uses a combination of two different factors, including something you know (e.g. User ID & Password) and something you have (e.g. Security Device), to verify user's identity. With the use of the Security Device, customers will be able to execute designated banking transactions or services.

- Automatic time out

E-Banking Services will be automatically logoff when there is no activity for 15 minutes in order to protect you against unauthorized access.

- Digital Certificates

The Symantec certificate on our web servers serve to prove to our customers

that we are who we claim to be, i.e. to confirm our identity.

Does BCM bank present any policy to fight against computer hacker?

Security is one of the main concerns for both the Bank and its customers when banking over E-Channels is concerned. This is one of the easiest and most convenient ways of banking, however, can be very sensitive to hack and online frauds if not properly protected and secured. The Bank adopted physical, technological and managerial security means and measures in order to maximize the security of our site and E-Banking Services.

- Security Support

To fight against computer hacker, BCM Network Security Team will keep track to any attempts that would break into our security systems in order to ensure the security. If you suspect there are unusual activities in your account, please contact us immediately.

- Firewalls

Our servers are protected behind two-layer firewalls of world-leading brands. They are constantly monitored to prevent any unauthorized access.

- Encryption

Communication between customer's browser and our servers is secured by using TLS (Transport Layer Security) protocol and encryption with 128-bit encryption keys, the industry standard for encryption of data over E-Channels. It means that any and all information exchanged between the customer and the Bank during E-Banking Services session is always encrypted.

- Cookies

E-Banking Services use cookies to store session identifier and to identify the user during the life of this particular session. Once the session is closed, the cookie will expire.

- Secure email

As the security of an ordinary email cannot be guaranteed, our secure Internet solution BCM Net e-E-Banking service contains also email facility under "Contact us" options, included in encryption mechanism. The Bank will use this facility to send any personal or transaction-related information to our BCM Net customers.

- Password security

The password security is strengthened by implementing rules that protect and prevent our customers from using easy to guess passwords, like for example strings of the same number or letter, or consecutive numbers. We also strongly advise our customers not to use their date of birth, telephone number or name as passwords, as other people can easily know this information.

- Last Logon Information

E-Banking Services also provide you with the information required to be vigilant. Each time you logon, we provide information related to your last banking session. If you find any discrepancies, please contact us immediately.

What should I do to keep safe my password?

To avoid unauthorized access to your account(s), you should pay attention to the following points:

Take good care of your Password

The Password of E-Banking Services are used to secure your online banking and execute of transactions, please do not disclose. You shall take all reasonable steps to keep the Password and Security Device with the following security tips:

Ø Do not disclose your Password in any occasion or to anyone else including your relatives, friends or our staff. You are suggested to change your Password after first successful login to respective E-Banking Services, memorize your Password and destroy the physical pin mailer thereafter.

Ø Avoid using easy-to-access numbers as your Password, such as your birthday, ID No., Phone No., or similar numbers or a recognizable part of your name as your Password.

Ø Do not write down or record your Password.

Ø Do not use same set of User Name / Password from other Internet sites (e.g. connection to the internet or accessing other websites).

Ø Do not allow any person to use your Password.

Ø Set a Password that is difficult to guess and different from the ones for other services. The Password should be changed regularly.

Ø Use both lowercase and capital letters with a combination of letters, numbers, and special characters.

Ø Do not write down your Password on any device (e.g. Security Device) or other mobile device for accessing E-Banking Services, etc or anything usually kept with or near the device or any personal belongings such as handbag or wallets.

Ø Regularly change your Password via respective E-Banking Services (e.g. 30 days).

Ø Contact us immediately if you believe that your E-Banking Services password has been compromised, lost or stolen. At the same time, please change your Password immediately to prevent unauthorized access to your E-Banking Services.

Ø Do not share your Security Device with any other person or pass to other person for safekeeping.

Ø Safeguard your Security Device and do not leave your Security Device unattended.

Ø Avoid using “Remember your password” options on Internet browsers. Do not click “yes” to “Remember your password” options on computers.

Never disclose your PIN and personal information

Ø The Bank will never contact you and ask you for your Password and personal information for E-Banking / Mobile Securities, phone banking, or ATM Services. These include your User Name, Password, account number, identification/passport number, address, phone number etc.

Ø The Bank will never disclose such information in our e-mails other than your name for personalization purpose, nor ask you to confirm any personal data by replying to our email.

Ø Customer must watch out for suspicious phone calls, email messages, SMS or phishing sites requesting for passwords and/or other personal information.

Protect your computer

Ø Install a personal firewall on your computer. Personal firewall software is designed to prevent hackers from accessing the computer it is installed on. Installing a personal firewall is recommended especially if you are using a broadband connection. You should contact your computer or software provider for a suitable personal firewall. When installing such software, follow the manufacturer’s recommendations for a ‘conservative’ accesses control.

Ø Install and regularly update virus detection software. Virus detection software scans your computer and your incoming email for viruses and then deletes them. You can download anti-virus software from the websites of software companies or buy it in retail stores. To be effective, anti-virus software must be updated routinely. As a matter of precaution, avoid opening any emails with attachments that you are not expecting, even if they are from known people.

Ø Be very cautious about opening attachments in emails from unfamiliar or suspicious sources which may be a virus or worm.

Ø Avoid visiting suspicious websites or downloading software or file from such websites.

Ø If any unusual screens pop up and/or the computer responds unusually slow, please log out from the site and E-Banking Services and scan the computer or internet browsers with the most updated version of virus protection software.

Protect your online transactions

Ø Beware of the site and E-Banking Services of any unusual login screen or process (e.g. a suspicious pop-up window or request for providing additional personal information) and whether anyone is trying to peek at your password.

Ø Do not access E-Banking Services from public places or from shared computers such as those in cyber cafes. You never know what malicious programs might be installed on the PC you use there.

Ø Avoid using public Wi-Fi to access E-banking Services.

Ø Always use the ‘Logout’ button to ensure you exit each E-Banking Services session securely. Closing of your internet browser only does not mean complete logout from your E-Banking Services.

Ø When you’ve finished using the Internet, always disconnect. Avoid leaving your connection on, especially with broadband access, unless you’re actively using it.

Ø Always check the date and time of your last visit to respective E-Banking Services (we track it at all times and display it on the Welcome Page). If you suspect anything unusual, please contact us immediately.

Ø Please take attention to review the transactions before confirmation. When your instructions have been accepted and confirmed online, they cannot be reversed and cancelled.

Ø For your protection, kindly login E-Banking Services and check your bank statement regularly and report any unusual transaction to the Bank immediately. For statement information and customer enquiries, please call customer service hotline during office hours.

Ø Check the SMS messages and other messages sent by the Bank in a timely manner. Verify your transaction records and inform the Bank immediately in case of any suspicious transaction identified.

Ø Do not forward telephone calls or SMS to devices or phone numbers provided by unknown others. When travelling abroad, it is advisable to use the same SIM card and cell phone in receiving phone calls and SMS instead of forwarding all SMS to another mobile phone or SIM card.

Alert to Email Scam

Email

is one of the main communication channels for both personal and commercial

dealings. Nowadays, fraudsters would hack into email accounts, and cheat

victims by all possible means to make remittances to them. Some victims have

suffered significant amount of losses from such email scams. You shall stay

alert to suspicious emails and raise your awareness in preventing this kind of

scam, such as taking the initiative to confirm the true identities of

recipients by telephone, facsimile or other means before effecting remittances

so as to prevent such kind of scam. Please read "What should I do to

keep safe my password?" and preventive measures to mitigate the risk

of hacking.

Make sure you are connected with BCM

If encounter some fraudulent websites that mimics the look of the financial institution’ website to capture your usernames, Password and other personal and confidential banking details. Thus, it is important to make sure that you are connecting with BCM. To stay away from connecting with a fraud website, never follow a link within an email to start an E-Banking Services. Always logon directly from your browser or select from your favorite if you have already added www.bcm.com.mo to your list of favorite Internet sites. This will avoid you from being sent to a false site. Remember: No e-mail from the Bank will contain a hyperlink to our E-Banking Services logon page.

To ensure that you are connecting with the Bank, look for closed security padlock at the top right corner of your Web browser before you enter your User ID and Password or important personal information. A closed security padlock indicates a secure connection. Clicking the closed padlock will show you the digital certificate details.

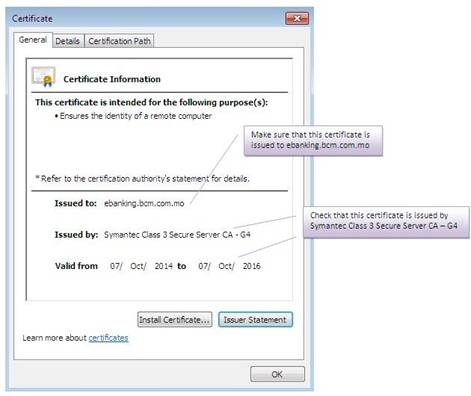

Sample screen shot of Internet Explorer’s certificate for your reference:

Note: After clicking the security padlock and you find the certificate contains any message different from what is illustrated above, please contact the Bank for more information or assistance.

To prevent logging into to the fraudulent online services, please do not click any link in emails or from other websites for logging into internet banking services.

If you find the website of the Bank suspicious, you should not enter any information (including usernames, Password) to the website and contact the Bank immediately.

Security measures for specific services

Security Tips for using Mobile Banking Services and/or Mobile Securities Trading Services (hereunder “Mobile Banking Services”):

Ø You shall take all the above-mentioned reasonable steps to keep your respective Password used for accessing Mobile Banking Services safe, secure and secret to prevent fraud.

Ø Immediately logout from Mobile Services after using the service or respective app.

Ø Check what Apps are running in the background mode and stop unnecessary Apps from running.

Ø Regularly login to check the account balances, stock holdings, order activity and transaction history.

Ø Please use authorized or official Apps from recognized suppliers on the mobile device.

Ø Please do not jailbreak, root or pirate your mobile device. The operating system must be legitimate and unaltered.

Ø Keep the operating system of your mobile device and Apps up-to-date. Download and upgrade your Apps from official App stores or reliable sources only.

Ø Do not leave your mobile device unattended.

Ø Activate the automatic locking function with a password on the mobile device that is difficult to guess.

Ø In public areas, please use secure network to connect with the internet on the mobile device. Avoid using public Wi-Fi to access Mobile Securities Trading Service.

Ø Disable any wireless network functions (e.g. Wi-Fi, Bluetooth, NFC) when not in use. Choose encrypted networks when using Wi-Fi and remove any unnecessary Wi-Fi connection settings.

Internet Privacy Policy Statement

It has been our policy and priority to safeguard any information provided by our customers. We will strictly comply with the requirements of the law and regulators in protecting customer personal data. We will train and require our staff to practice this Privacy Policy at all times.

In visit to our website, we collect no personal data from any customer for only browsing, except updating the statistics on the number of visitors. Throughout the website, only the necessary information for applications / enquiry submitted by customers will be collected, and the customers will be informed of the purposes and uses. In order to ensure the security and confidentiality of personal data we collect, encryption techniques have been applied in E-Banking / Mobile Securities Services for data transmission. We will not collect any information from customers without notice.

Once we obtain customer's personal information, only the authorized staff will be permitted to access to that information, and it will not be revealed to any external organizations without customer's agreement unless it is required to do so by law. From time to time, we may send promotional materials regarding our products to customers according to the collected information.

Contact Us

We will continuously assess ourselves to ensure that our customer privacy is properly respected and protected. For details, please refer to the Notice to Customers Relating to Customers' Data. Should you have any questions, please contact us through:

The Data Protection Officer

Banco Comercial de Macau

Avenida da Praia Grande No. 572

Macau

Tel: 8791 0669

Fax: 2859 5817

In case of discrepancy between the Chinese and English versions, the Chinese version shall prevail.

Last updated on 06 Jan 2017